In the dynamic world of real estate, staying updated with market trends is crucial for both buyers and sellers. With a plethora of factors influencing the housing market, from economic conditions to seasonal fluctuations, it’s essential to analyze data to understand where the market stands and where it might be headed.

Let’s take a deep dive into the market data from February 2024 and compare it with the current month, March 2024, to discern any notable changes and potential implications.

February 2024: A Recap

In February 2024, the real estate market showed steady activity, with 1,703 active listings. Among these, 1,016 were under contract, indicating a healthy level of interest from buyers. Additionally, 469 properties were sold during the month.

The average list price stood at $310,000, with properties fetching an average sale price of $305,000. The average number of days on the market, from listing to sale, was 117 days.

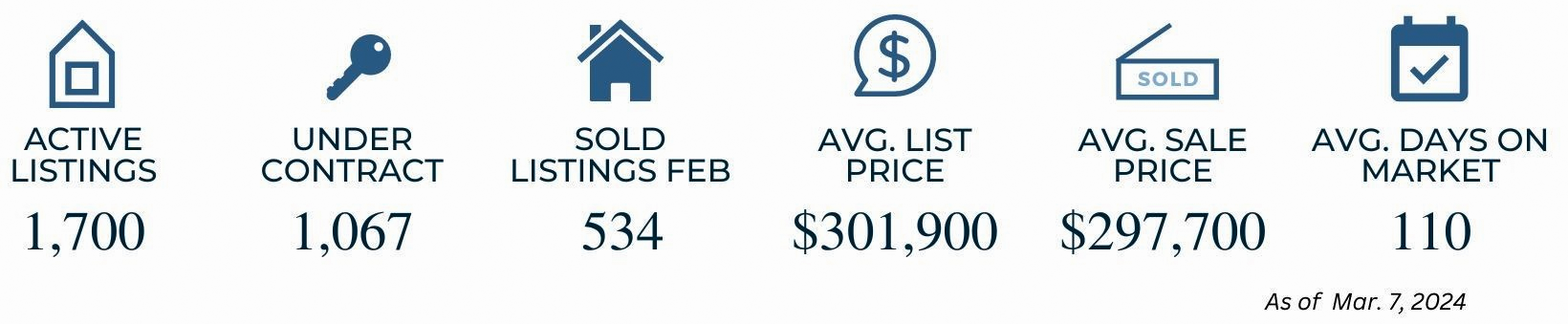

March 2024: Current Insights

As of March 7th, 2024, the real estate market has seen some interesting shifts compared to February. While the number of active listings remains relatively stable at 1,700, there’s been a notable increase in properties under contract, rising to 1,067. This uptick suggests heightened buyer activity and potentially increased competition in the market.

The number of properties sold in March also experienced a significant jump, reaching 534, compared to 469 in February. However, there’s a slight decrease in the average sale price, dropping to $297,700 from $305,000 in the previous month. This dip could be attributed to various factors such as changes in buyer preferences, increased inventory of lower-priced properties, or adjustments in the local economy.

Despite the decrease in average sale price, the average list price has seen a modest increase, rising to $310,900 in March. This suggests that sellers are still optimistic about the value of their properties, although buyers might be negotiating for lower sale prices.

Another noteworthy change is the reduction in the average number of days on the market, dropping to 110 days in March compared to 117 days in February. A shorter time on the market indicates increased efficiency in property sales, possibly driven by factors like competitive pricing, high demand, or effective marketing strategies.

Implications and Considerations

The comparison between February and March 2024 highlights several key insights into the real estate market’s dynamics:

1. Increased Buyer Activity: The rise in properties under contract and sold listings indicates a surge in buyer interest, potentially driven by factors like favorable mortgage rates or improving economic conditions.

2. Price Fluctuations: While the average list price has slightly increased, the average sale price has decreased. This could signal a shift in bargaining power towards buyers or changes in the types of properties being sold.

3. Market Efficiency: The decrease in days on the market suggests a more efficient selling process, benefiting both buyers and sellers. However, it’s essential to monitor this trend to ensure sustainability and avoid potential market imbalances.

4. Market Resilience: Despite fluctuations, the real estate market remains resilient, adapting to changing conditions and maintaining overall stability.

Analyzing market data provides valuable insights into the current state of the real estate landscape. By comparing February and March 2024 statistics, we can discern trends, anticipate market movements, and make informed decisions whether buying, selling, or investing in properties. As the market continues to evolve, staying vigilant and adaptable is key to navigating its complexities successfully.